Introduction

In a surprising resurgence of trade protectionism, former U.S. President Donald Trump announced a sweeping set of new tariffs scheduled to take effect from August 1, 2025. This move signals a continued commitment to his “America First” agenda, aiming to address persistent trade imbalances, protect domestic industries, and incentivize onshore manufacturing.

The latest tariffs target imports from 14 countries, including key U.S. allies and trading partners in Asia and Europe. The announcement has sent shockwaves through global markets, raising concerns about escalating trade tensions and potential retaliatory measures.

Background: The Rise of Tariffs in U.S. Trade Policy

Trade tariffs are taxes imposed on imported goods to make them more expensive and thus protect domestic producers from foreign competition. While tariffs have long been used as a policy tool, the past decade saw a significant escalation under Trump’s presidency, with tariffs on steel, aluminum, and various Chinese goods.

Between 2018 and 2020, Trump imposed tariffs on over $350 billion worth of Chinese imports and dozens of other countries, leading to retaliatory tariffs and a global trade war. These measures were justified as necessary to reduce trade deficits, protect American jobs, and counter unfair trade practices.

Despite changes in administration, the 2025 tariff announcement reflects ongoing concerns over the U.S. trade balance and the desire to bring back manufacturing jobs.

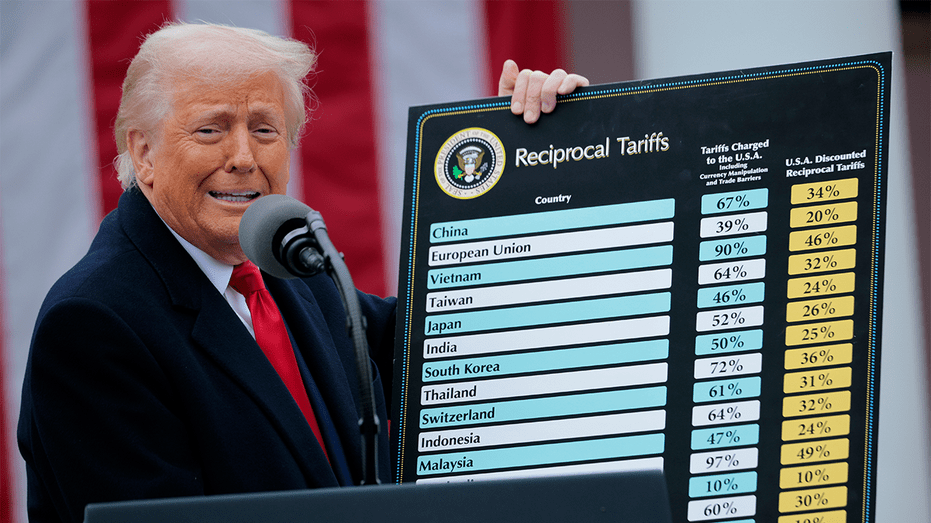

Overview of the New Tariffs

The new tariffs apply broadly to all goods imported from the following countries, with rates varying between 25% and 40%:

- Japan and South Korea: 25% tariff

- Malaysia, Kazakhstan, Tunisia: 25% tariff

- Laos and Myanmar: 40% tariff

- South Africa: 30% tariff

- Indonesia: 32% tariff

- Bangladesh: 35% tariff

- Thailand and Cambodia: 36% tariff

- Bosnia and Herzegovina: 30% tariff

- Serbia: 35% tariff

In addition, the administration has announced plans for a 200% tariff on pharmaceutical imports unless production is relocated to the U.S. within an 18-month grace period. This unprecedented move seeks to revive domestic pharmaceutical manufacturing and reduce dependence on foreign suppliers.

Economic Implications

Domestic Impact

- Protection of U.S. Industries: Tariffs are designed to make imported goods more expensive, encouraging consumers and businesses to buy domestically produced alternatives. This can help protect jobs in manufacturing, mining, and related sectors.

- Price Increases: Consumers may face higher prices on everyday goods, from electronics to clothing, as importers pass increased costs onto buyers.

- Supply Chain Disruptions: Global supply chains that rely on cross-border trade may face delays and increased costs, potentially reducing efficiency and increasing costs for U.S. businesses.

Global Market Reactions

- Commodity Prices Surge: The announcement of a 50% tariff on imported copper led to a record surge in U.S. copper futures, marking one of the largest single-day gains in decades. Mining stocks, including Freeport-McMoRan and Southern Copper Corp., soared as investors anticipated increased domestic demand.

- Trade Partners’ Economies: Countries affected by the tariffs risk losing market access and facing reduced export revenues, which could slow their economic growth and destabilize regional markets.

Political and Diplomatic Repercussions

Domestic Politics

- Supporters: Advocates argue tariffs protect American workers, reduce trade deficits, and restore industrial strength. They view these measures as essential to rebuilding a competitive manufacturing sector.

- Critics: Opponents warn of retaliation from trade partners, increased costs for consumers, and harm to U.S. businesses relying on imported components. Many economists caution that tariffs can lead to trade wars, ultimately damaging global economic growth.

International Reactions

- Allied Responses: Japan and South Korea, key U.S. allies, have expressed concern and are reportedly exploring diplomatic channels to negotiate exemptions or concessions.

- Trade Disputes: Countries facing high tariffs may file complaints with the World Trade Organization (WTO) or impose retaliatory tariffs on American goods, potentially escalating tensions.

- Global Trade Uncertainty: The tariffs add to a broader climate of uncertainty in global trade, impacting investment decisions and economic forecasts worldwide.

Strategic Goals and Long-Term Outlook

The tariffs are part of a broader strategy emphasizing “reciprocal trade”—ensuring trading partners provide fair access to their markets comparable to what the U.S. offers. This approach aims to reduce trade deficits and address what are seen as unfair trade practices like subsidies and intellectual property theft.

By pushing for onshoring of critical industries, particularly pharmaceuticals, the administration seeks to enhance national security and reduce vulnerabilities exposed by global supply chain disruptions during events like the COVID-19 pandemic.

However, the long-term success of this strategy depends heavily on:

- Negotiations with Trade Partners: Will countries agree to terms that prevent escalation?

- Economic Adaptability: Can U.S. industries ramp up production to meet demand without inflating costs?

- Global Cooperation: Balancing protectionism with the benefits of open trade.

Conclusion

President Trump’s new tariffs mark a bold reaffirmation of protectionist trade policies designed to reshape the U.S. economy and its position in the global market. While the goals of protecting jobs and ensuring fair trade are clear, the potential for increased consumer costs, trade disputes, and global economic instability presents significant challenges.

As August 1, 2025, approaches, the world watches closely to see how trading partners respond and how these tariffs will influence the future of international trade.

Leave a comment